The Definitive Guide for Truck Insurance In Dallas Tx

Wiki Article

What Does Truck Insurance In Dallas Tx Mean?

Table of ContentsThe 3-Minute Rule for Insurance Agency In Dallas TxOur Health Insurance In Dallas Tx IdeasMore About Life Insurance In Dallas TxThe Best Strategy To Use For Truck Insurance In Dallas TxHow Health Insurance In Dallas Tx can Save You Time, Stress, and Money.Life Insurance In Dallas Tx Can Be Fun For Anyone

The costs is the amount you pay (normally regular monthly) for medical insurance. Cost-sharing describes the section of eligible healthcare costs the insurer pays and the portion you pay out-of-pocket. Your out-of-pocket expenses might consist of deductibles, coinsurance, copayments as well as the complete expense of healthcare services not covered by the plan.High-deductible plans go across groups. Some are PPO plans while others may be EPO or HMO plans. This kind of wellness insurance has a high deductible that you need to fulfill before your health and wellness insurance protection takes result. These strategies can be right for people who desire to save cash with reduced regular monthly premiums as well as do not plan to utilize their clinical coverage extensively.

The downside to this sort of protection is that it does not satisfy the minimal vital insurance coverage called for by the Affordable Treatment Act, so you may likewise undergo the tax fine. Additionally, temporary plans can exclude coverage for pre-existing problems. Temporary insurance policy is non-renewable, and also does not consist of insurance coverage for preventative treatment such as physicals, injections, dental, or vision.

The 2-Minute Rule for Health Insurance In Dallas Tx

Consult your own tax obligation, accounting, or legal advisor rather than counting on this article as tax, audit, or lawful guidance.

You can typically "omit" any household member who does not drive your auto, however in order to do so, you have to submit an "exclusion form" to your insurer. Vehicle drivers that just have a Student's Authorization are not called for to be noted on your policy till they are totally accredited.

The Single Strategy To Use For Home Insurance In Dallas Tx

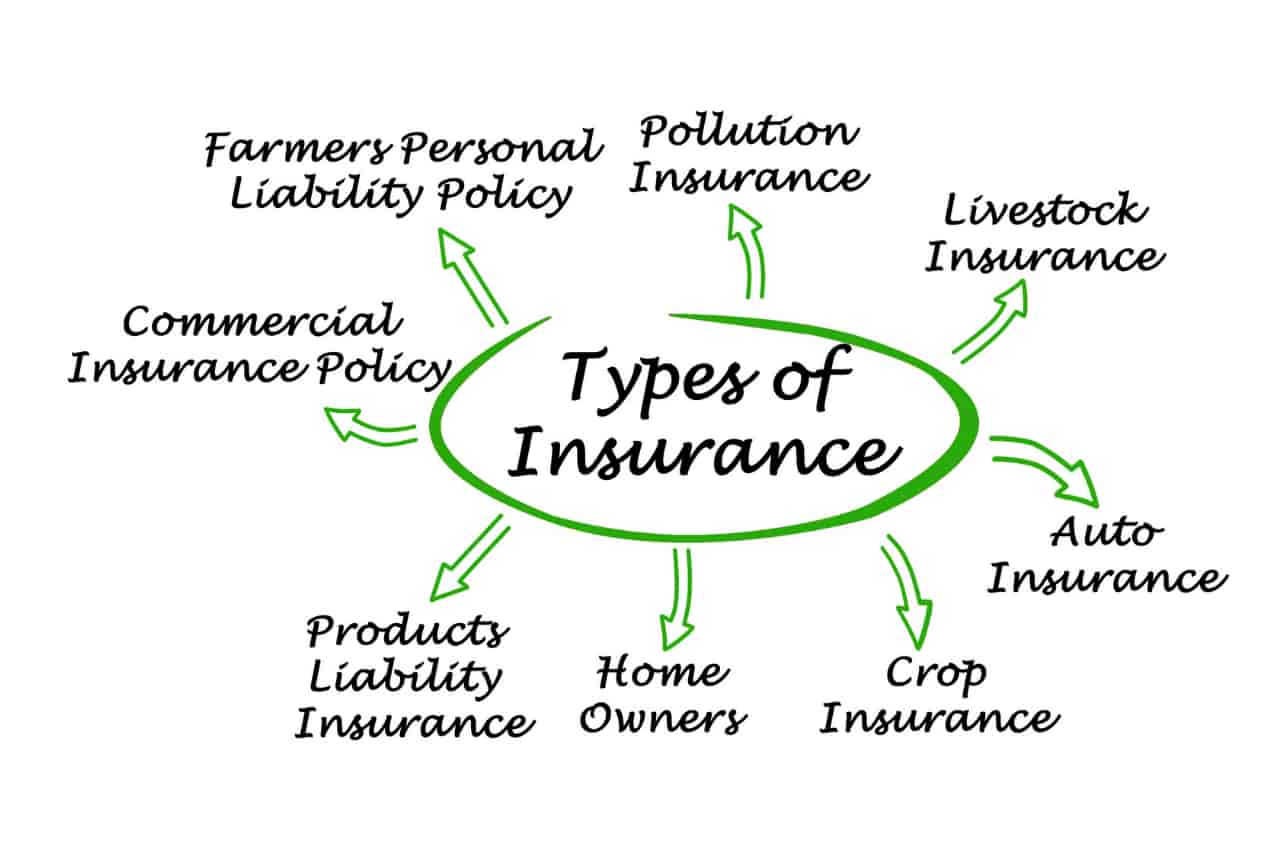

You require to purchase insurance coverage to shield on your own, your family members, as well as your wide range (Insurance agency in Dallas TX). An insurance coverage policy can save you countless bucks in case of an accident, disease, or catastrophe. As you strike certain life turning points, some plans, including medical insurance as well as vehicle insurance policy, are virtually required, while others like life insurance as well as special needs insurance policy are highly urged.Accidents, disease as well as calamities happen at all times. At worst, occasions like these can dive you right into deep monetary ruin if you don't have insurance to fall back on. Some insurance coverage are inevitable (believe: car insurance policy in most US states), while others are simply a clever monetary decision (think: life insurance policy).

Plus, as your life modifications (state, you get a brand-new work or have an infant) so should your coverage. Listed below, we've clarified briefly which insurance policy protection you ought to strongly consider buying at every phase of life. Note that while the policies listed below are organized by age, obviously they aren't prepared in stone.

The 20-Second Trick For Life Insurance In Dallas Tx

Below's a brief summary of the policies you require as well as when you require them: A lot of Americans need insurance coverage to pay for healthcare. Choosing the plan that's right for you might take some research study, yet it offers as your initial line of protection against medical financial debt, among biggest sources of debt amongst customers in the United States.a knockout post In 49 of the 50 US states, vehicle drivers are required to have auto insurance policy to cover any kind of possible residential property damage and bodily injury that might arise from get redirected here a mishap. Automobile insurance policy prices are mainly based on age, credit scores, automobile make as well as design, driving record and area. Some states also think about gender.

The Facts About Life Insurance In Dallas Tx Revealed

An insurance firm will certainly consider your residence's area, along with the dimension, age and also develop of the house to identify your insurance policy costs. Residences in wildfire-, hurricane- or hurricane-prone areas will certainly practically always command higher costs. If you market your residence and also go back to renting out, or make various other living setups (Insurance agency in Dallas TX).

For individuals that are aging or disabled and require assistance with everyday living, whether in a retirement home or through hospice, lasting care insurance can help bear the exorbitant costs. This is the kind of thing individuals do not consider up until they age and also recognize this could be a fact for them, however naturally, as you grow older you get extra expensive to guarantee.

Essentially, there are 2 find kinds of life insurance policy plans - either term or irreversible plans or some mix of the two. Life insurance providers offer various kinds of term plans and also conventional life plans in addition to "interest delicate" items which have come to be much more widespread because the 1980's.

The Definitive Guide to Home Insurance In Dallas Tx

Term insurance offers protection for a specified amount of time. This duration could be as short as one year or provide insurance coverage for a specific number of years such as 5, 10, 20 years or to a defined age such as 80 or in some instances approximately the earliest age in the life insurance policy mortality tables.

The longer the guarantee, the greater the initial costs. If you die throughout the term period, the firm will pay the face quantity of the policy to your recipient.

Report this wiki page